Introduction

Bookkeeping is actually typically identified as a mundane as well as dull task, delegated to the shadows of even more glamorous line of work. However, the fact is much various. Behind each amount as well as ledger is a planet filled with ideas, strategy, and also essential decision-making processes. Within this write-up, we'll trip by means of A Day in the Lifestyle of a Bookkeeper: What They Actually Do Coming from understanding their regular activities to untangling the intricacies that accompany their responsibilities, our company strive to elucidate this crucial profession.

What Is Bookkeeping? An Overview

Understanding the Basics of Bookkeeping

Bookkeeping is the step-by-step audio of financial deals in a business. It entails keeping accurate files of all financial tasks, consisting of sales, investments, vouchers, and also payments.

The Usefulness of Exact Record-Keeping

Accurate bookkeeping makes certain that services may track their revenue as well as costs successfully. This details help in budgeting, tax obligation preparation, and overall economic health.

A Time in the Lifestyle of a Bookkeeper: What They Truly Do

Starting the Time: The Morning Routine

Most accountants begin their time early. Usually getting to the office around 8 or 9 AM, they begin through assessing e-mails as well as messages from clients or even staff members.

Checking E-mails as well as Messages

They spend about 30 minutes sorting via correspondence to prioritize important matters or client inquiries.

Gathering Important Documents

Once communications are figured out, accountants acquire invoices, receipts, banking company statements, as well as any other applicable documents needed for their time's work.

Diving in to Data Entry: The Heart of Bookkeeping

Data entry forms the primary function of a bookkeeper's project.

Recording Deals Accurately

Each purchase have to be actually captured painstakingly to prevent discrepancies later on. This might involve inputting records in to program like QuickBooks or Excel sheets.

Managing Accounts Payable and also Receivable

Bookkeepers handle profiles payable (loan been obligated to pay by the company) and receivable (loan been obligated to pay to the business). Monitoring these profiles makes certain prompt repayments and also capital management.

Reconciliations: Making certain Accuracy Throughout Accounts

Bank Getting back together Process

One crucial task is actually reconciling bank declarations along with interior reports to ensure every thing compares-- a critical measure to identify errors quickly.

Compare purchases from banking company claims with those recorded. Investigate any sort of discrepancies immediately. Make important corrections in files if required.Vendor Reconciliations

In enhancement to bank getting backs together, accountants additionally fix up seller accounts every now and then to take care of superior costs accurately.

Utilizing Technology: Program in Bookkeeping

The Function of Bookkeeping Software

Modern bookkeeping heavily relies on technology.

Popular Tools Used through Bookkeepers

- QuickBooks Xero FreshBooks

These tools not just simplify data access but additionally offer enhanced attributes like stating and also analytics.

Communicating with Clients: Building Relationships

Bookkeepers spend an aspect of their time communicating with customers or even providers-- addressing inquiries about invoices or supplying updates on profile status.

Regular Client Check-ins

Regular check-ins aid sustain tough relationships with clients while making sure that assumptions are actually aligned pertaining to monetary matters.

Preparing Monetary Documents: Study Information Trends

Monthly Documents Generation

At month-end, bookkeepers create reports summarizing numerous financial metrics consisting of profit & & loss statements and also balance sheets.

Gather all appropriate data. Utilize bookkeeping software program for reporting. Analyze styles for decision-making support.Identifying Regions for Improvement

By studying these documents, accountants can pinpoint areas where businesses can reduce expenses or even increase revenue-- a https://boekhouder020.blogspot.com value-added company they give past plain record-keeping.

Tax Planning: Collaborating along with Accountants

Understanding Tax Obligations

As tax obligation season methods, accountants help in readying documentations for bookkeepers by managing all needed documentation related to earnings as well as expenditures throughout the year.

Filing Tax obligations Efficiently

This cooperation simplifies tax filings ensuring observance while taking full advantage of deductions readily available for clients-- a critical part in local business operations.

Ongoing Education and learning: Keeping Updated on Regulations

Importance of Continuing Education

To stay efficient in their tasks, accountants have to follow improvements in income tax laws or even accounting specifications by means of ongoing education programs.

Workshops and also Seminars

Many accountants attend study groups or even workshops consistently which also provide making contacts options within their business-- a win-win situation!

FAQ Section

1. What qualifications do you need to become a bookkeeper?

While there are actually no rigorous needs, possessing an associate degree in audit or even money may be favorable. Lots of prosperous bookkeepers also go after qualifications such as Certified Bookkeeper (CB) designation offered by organizations like AIPB (United States Principle of Expert Bookkeepers).

2. How performs bookkeeping vary coming from accounting?

While both industries deal with finances, bookkeeping focuses on capturing everyday transactions while accounting involves deciphering economic records for key decision-making purposes.

3. What software program do very most accountants use?

Most accountants use software program like QuickBooks, FreshBooks, or Xero for effective record-keeping and mentioning functionalities relying on client needs.

4. May I choose a remote control bookkeeper?

Absolutely! Along with advancements in innovation enabling smooth communication via cloud-based platforms, several companies currently opt for remote bookkeeping companies saving costs without weakening quality!

5. For how long does it require to come to be competent at bookkeeping?

With devoted method-- generally 6 months to pair of years-- you may come to be skillful adequate depending on your prior expertise level!

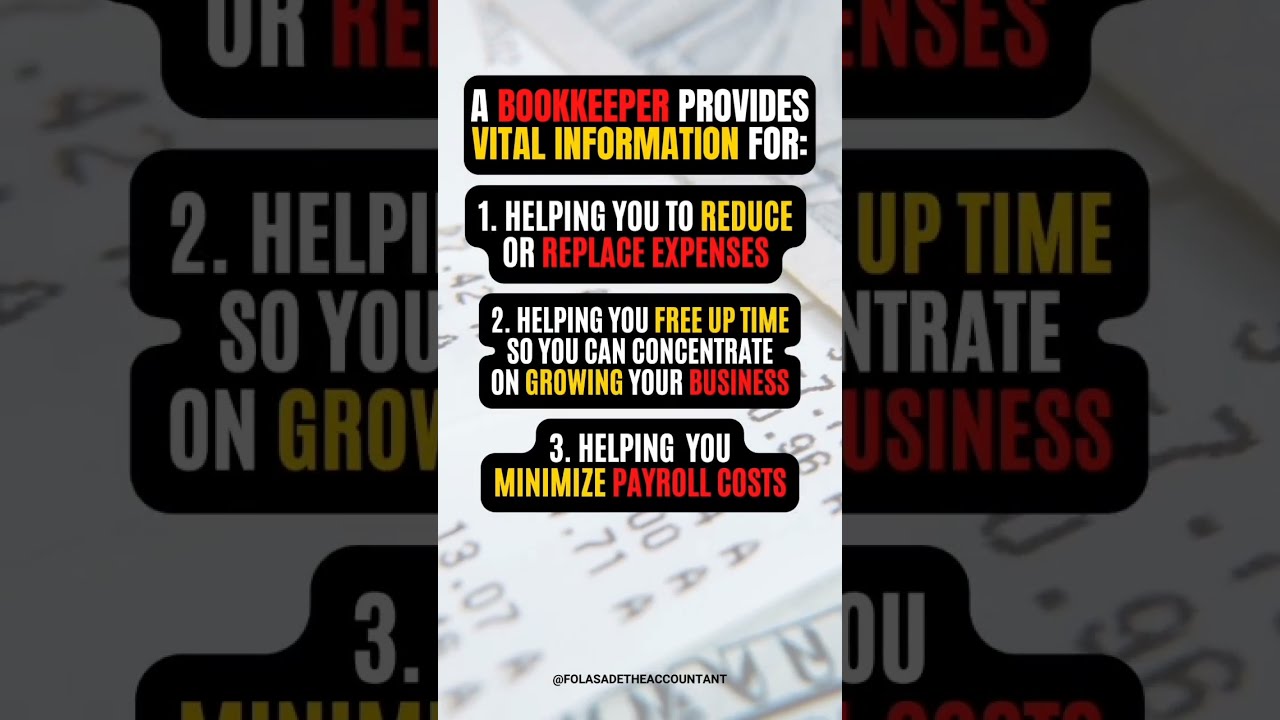

6. Why ought to I take into consideration hiring a professional bookkeeper?

Hiring a qualified frees up your opportunity enabling you to pay attention to growing your company instead of getting hung up by management obligations while making sure precision & & compliance!

Conclusion

A day in the life of a bookkeeper might show up regular in the beginning look; having said that it involves a lot more than simple records access-- it's about nurturing solid relationships with customers while producing crucial understandings that steer organization decisions onward! Through understanding what they definitely perform day-in-and-day-out our company acquire growth not just for varieties-- but also tactical believing responsible for them! Thus following opportunity you listen to 'bookkeeping', remember it's certainly not pretty much maintaining publications; it concerns creating futures!

In conclusion, this comprehensive examine "A Day in the Life of a Bookkeeper: What They Actually Do" emphasizes exactly how important this job is actually within any sort of association-- giving clarity among chaos!